In France, car insurance is compulsory: another expense that cannot be avoided! Fortunately, there are solutions to pay for it as cheaply as possible. Here are some tips and tricks for finding a cheap car insurance without renouncing the quality of the guarantees offered.

How to get cheaper car insurance?

To take out cheap car insurance, Assurland recommends that you do a car insurance simulation before taking out and follow our various recommendations.

- Know the criteria that can reduce your contribution : park your vehicle in a private and closed garage, opt for a used car, use it moderately to reduce the risk of accidents.

- Adjust the level of the deductible : with high deductible amounts, the premium will be reduced.

- Pay your insurance every year : this can allow you to benefit from a reduction of 5 to 10% on the price of your car insurance contract.

- Choose online insurance : the new digital insurance companies (Direct Assurance, l’Olivier Assurance), or those called “insurtech” (Lovys, Leocare, Wilov) often offer more attractive rates than traditional insurance companies.

- Get bonuses : for each year without a claim, you will receive a 5% bonus, thus reducing your premium.

Save up to 40% at

your Car Insurance

Switch to a cheaper contract

Finding cheap car insurance isn’t just for new drivers – already insured drivers can also find car insurance that’s cheaper than their current contract and change it very easily.

With the Hamon law, cancel your insurance easily

Hamon law allows you to cancel your car insurance at any time after a year of subscription, and no longer just at the annual deadline.

What are the steps to cancel car insurance?

Thanks to the Hamon law, you no longer have to deal with dismissal procedures; once the new contract is signed, yours new insurer will take care of the formalities for you with your old insurance.

You can also send a registered letter with acknowledgment of receipt (LRAR) to your insurer at least 2 months before the deadline of your car insurance contract to request cancellation.

Compare to save

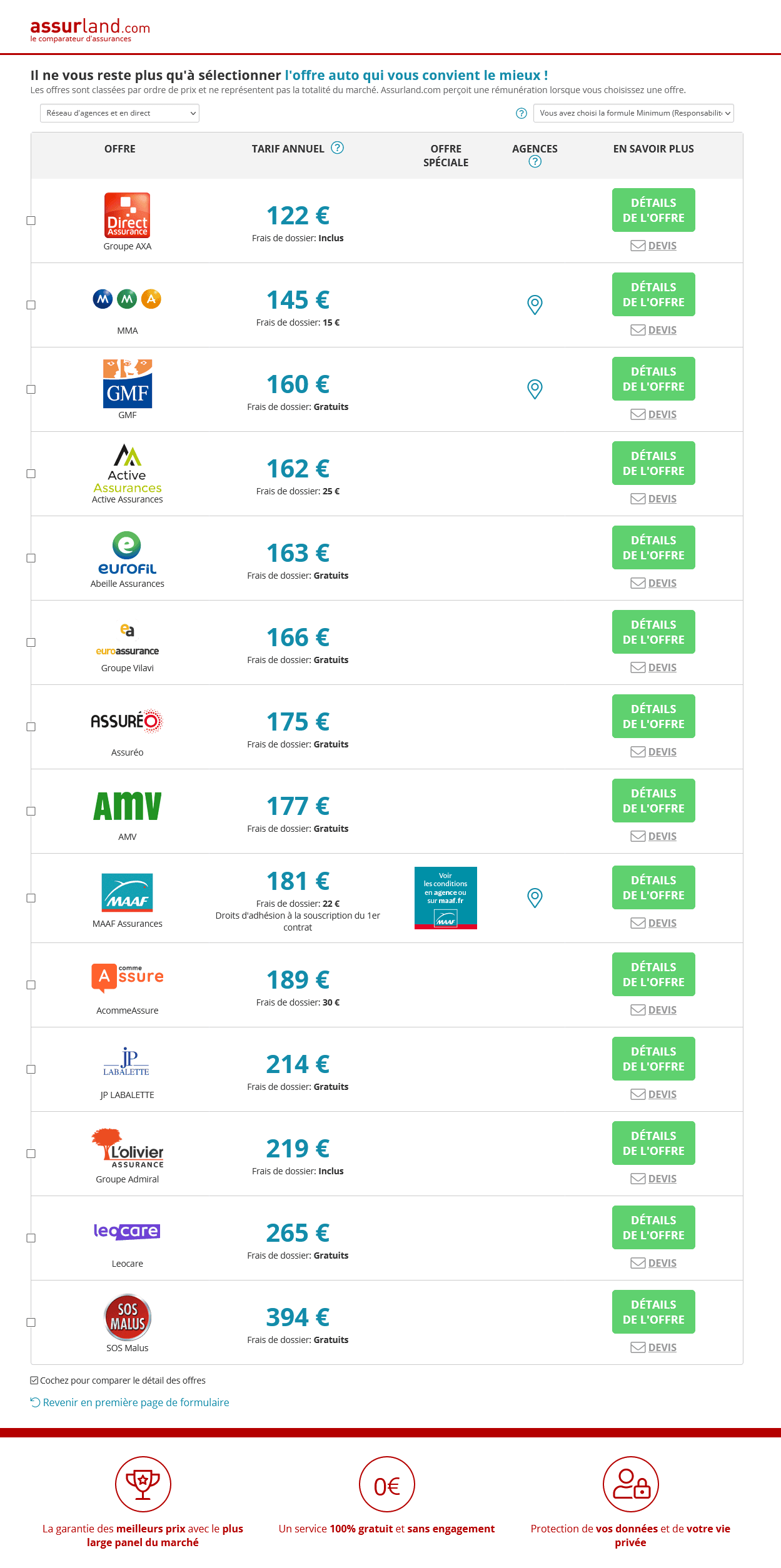

Using an online auto insurance comparator is the best way to do this find the insurer who will offer you the cheapest rate of the market. Our site allows you to:

- get tailor-made car insurance quotes from different insurers,

- to view the prices offered from cheapest to most expensive, easily comparing their guarantees,

- save precious time: no need to go around insurers to find the cheapest insurance quote, they come to you!

Thanks to a single site, you can have an overview of the different prices charged by insurers. Enough to quickly get the best deals on the market and levels of coverage to insure your vehicle. As a bonus, if you are interested in a quote, you will also have the option of taking out your cheap car insurance online for be insured during the day.

Which car insurance formulas to choose?

The first point to address is that of choosing the car insurance formula. To pay less for your coverage, avoid all-risk insurance, which remains the most expensive on the market, and opt for a third-party or kilometer contract.

Third party insurance

Third party insurance is the level of mandatory minimum coverage. Also called “Civil Responsibility” (RC), or basic insurance, it only covers material and bodily damage caused to third parties following an accident or in the event of an accident. It is therefore the least protective insurance on the market, but it is also the one that allows it save more!

Price example for liability insurance

Methodology: The study was based on the following profile: Male, 55 years old, unmarried, resident in Vannes, owner of a CITROËN C1 Essence Sedan VTI 68 Shine (registered in 2015) for private use and commuting to work, without loss or cause of accident for 3 years, bonus 0.50, driving 10,000 km/year and parking in individual closed garage.

The last 3 third-party quotes obtained with our comparator

Vehicle

Insurer

Annual price (€)

CITROËN C5 II

CITROËN C5 II

OPEL CORSA

* Rates may vary according to your profile (age, bonus-malus…)

Insurance per kilometre

Insurance per kilometer and Pay As You Drive are insurance policies whose prices are calculated on the basis of the number of km traveled per year:

- With mileage insurance you undertake not to exceed a certain number of kilometers in a given period: this is the “mileage package“;

- With Pay As You Drive, the price of car insurance depends on the number of kilometers travelled: the more you drive, the more you pay .

Young, terminated, dilapidated, how to pay less?

For some insured profiles, the car insurance bill can be particularly high.

Lower the price of young driver insurance

Young drivers are considered risk profilesin the eyes of insurers. This is why auto insurance premiums have often increased.

However, you can lower your bill to find cheap insurance:

- pass license accompanied guide,

- buy a used car,

- take out insurance withparent’s insurer,

- compare market offers via a insurance comparator.

Driver harassed, fired: tips for cheaper insurance

As an injured or terminated driver, finding an insurer can be tricky and will see your premium increase. Using our comparator, you can insure your vehicle for less.

The cheapest cars to insure in 2022

Methodology: The study was based on the following profile: female aged between 35 and 40, resident in Brittany, with a bonus of 0.5, who has never had an accident or accident and drives a car of at least 8 years old. The required formula is civil liability insurance.

The cheapest brands to insure in 2022

Depending on the make of your vehicle, prices may vary. Here is a top 10 of the cheapest car brands to insure.

It can be seen that Japanese auto insurance is the cheapest in the market. Mitsubishi vehicle insurance is the cheapest with an average premium of 412 euros. The podium is then completed by the manufacturers Dacia with an annual bonus of 416 euros and Suzuki with a price of 514 euros.

Cheap car insurance FAQs

-

How to lower your car insurance premium?

To lower your auto insurance premium and save money, you’ll need:

- drive carefully to acquire bonuses,

- park your vehicle in a safe place ,

- withdraw the guarantees that you don’t need,

- compare with other offersof the market.

-

How to buy cheap car insurance?

To get cheap car insurance, you can:

- opt for an economic formula with a low level of coverage,

- pick one low cost insurance company ,

- reduce your premium by choosing a high deductibleif you have no pretensions,

- pay attention to tuition fee.

-

What is the average cost of insurance?

According to a study by Assurland.com conducted in December 2022, the average cost of car insurance in France is 630 euros per year. The region with the lowest average price in France is Brittany with an average premium of 491 euros.

-

What is the cheapest insurance company?

Several insurers have specialized in attractive auto insurance rates. According to the Opinion-assurances website, it is L’olivier insurance, direct insurance and GMF that get the best marks in terms of prices. The insurance companies Eurofil and Better are also often mentioned.

#Cheap #car #insurance #comparator #quote

.png)

Comments

Post a Comment