Would You like Bike Insurance for Your Bicycle?

Your homeowners' insurance can cover bike-related issues like thieving or roguishness.

however, if you’re not a house owner, you'll be able to notice coverage in alternative places, like renters' insurance, dwelling insurance, or perhaps standalone bike insurance.

Pedal on as we tend to examine the various spokes of bicycle insurance.

How are bicycles insured?

Bicycles are generally insured under the non-public property section of a homeowners', dwelling, or renters' insurance policy.

Here’s a glance at how different types of motorcycle issues are lined up.

Theft and roguishness

If your bike is stolen or vandalized, you're covered under your home, renter, or dwelling insurance.

The amount of the claim depends on whether or not you selected cost or actual money worth (ACV) coverage.

The cost could pay for a replacement bike of an analogous model. ACV pays just for the depreciated value of your bike.

An insurance deductible can apply in cases of thieving or roguishness. The deductible is the quantity that's subtracted from the associate claim check. as an example if your bike is priced at $1,000 and you've got a $500 deductible, you may get a $500 claim check ($1,000 – $500 = $500).

Bicycle damage

If your bike is broken, however, it’s lined by your home, dwelling insurance, or renters' insurance depending on the truth. Here’s a glance at however a couple of situations may be covered:

- Your bike is broken in an extreme automobile accident while you're transporting it. Your home, condo, or renter's insurance can cover you, up to your policy limits, and your deductible can apply.

- Another driver crashes into your bike. If another driver crashes into your bike, you'll be able to file a claim against their liability insurance.

- Your bike is destroyed in an exceedingly house fireplace. Your home, renters, or dwelling insurance may cover a fireplace. At the value of substitution, your bike is going to be lined up, up to your policy limits, and your deductible can apply.

- You crash your bike. If you crash into an object like a tree or automobile, you usually won’t be covered by a home, condo, or renter's insurance for the bike injury.

Bike-Related Injuries

If you're abraded in an exceeding bike accident, you'll be lined, reckoning on the scenario:

- A driver crashes into you. Your medical expenses are often listed below the driver’s liability insurance. If the driver is uninsured, your insurance will cover your medical bills. Depending on your state, you'll even have coverage below the non-public injury protection (PIP) portion of your insurance policy.

- You crash into an associated object. If you hit an object, such as a tree or automobile, your insurance can cover your medical expenses.

Injury to others

If you mistakenly crash into somebody and cause injuries, their medical expenses are often covered by the liability portion of your home, condo, or renters' insurance.

Property injury to others

If you crash into somebody else’s property and cause injury, like denting an automobile, the liability portion of your home, condo, or renters' insurance could cover the property injury.

When Do I Need Separate Bicycle Insurance?

The Insurance Data Institute suggests that if you own an upscale bike, you ought to raise a concern about an associate add-on to homeowners' or renters' insurance, called an associate endorsement, that permits you to schedule material possession.

This boosts your coverage. You'll be able to conjointly explore a standalone bike insurance policy.

Bike insurance policies sometimes offer broader and deeper coverage than homeowners' or renters' insurance policies Markel says one of its bike insurance policies covers things like crash injury, wayside help, spare components, and replacement-bike rentals, whereas a typical homeowners' or renters' insurance doesn't.

Trusted Choice, a network of freelance insurance agents, says you ought to examine standalone bike insurance if:

- You spent plenty of cash on your bike. An everyday bike may cost a little over $200 to $700, whereas a specialty bike will cost over $1,000.

- You frequently ride cross-country, doubtless putting your bike at greater risk.

- You contend in athletic events.

- You own a motorcycle that’s been specially designed, upgraded, or changed.

- You lack homeowner's or renter's insurance.

How Much Will Bicycle Insurance Cost?

You can get a standalone bike insurance policy for about $100 to $300 a year.

Markel and another bike underwriter, Veloinsurance, say their annual premiums begin at $100. Markel’s average bicycle insurance price is $250 to $300 a year.

Should You File a Claim if Your Bike Is Purloined or Damaged?

If your bicycle claim is for a smaller amount than or solely slightly less than your insurance deductible, you'll not wish to file a claim.

AsForxample, if your bike was priced at $600 before it was destroyed, but your householders' policy contains a $500 deductible, it doesn’t make financial sense to file a claim. A claim is probably going to extend your home payment, and you'd only get $100 from your insurer.

How to find the simplest bicycle insurance for you

To find the simplest bicycle insurance, a decent place to begin is with a policy you'll already have. Your home, renters, or dwelling insurance covers your bicycle for sure issues like thieving and roguishness, up to your policy limit.

If you own an upscale bike or if your home, renter's, or dwelling insurance is meagerly for your desires, contemplate a standalone bicycle insurance policy. These types of policies generally have broader coverage.

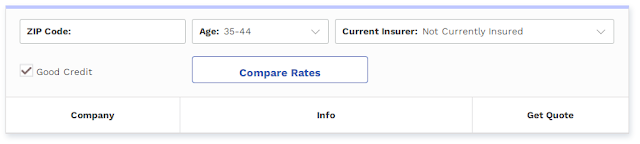

Before you get a standalone policy, compare coverage choices and acquire quotes to find the cheapest bicycle insurance.

Here are some corporations that sell bicycle insurance.

Markel

Markel’s bicycle insurance can pay the cofullalue of your bike if it's stolen or broken thanks to a tangle lined by the policy.

The corporate jointly sell coverage sorts like replacement bike rental, event fee compensation, sports coverage, electrical bike coverage, and crash injury coverage.

You'll be able to get both medical payment coverage if you're hurt while riding, with limits starting from $1,000 to $10,000.

Markel offers liability coverage in amounts that vary from $25,000 to $300,000.

Simple Bike Insurance

Simple Bike Insurance covers your bike at full value if it's stolen or broken thanks to a tangle lined by the policy. you'll be able to purchase coverage sorts like spare components coverage, sports coverage, and replacement bicycle rentals. you'll be able to get medical payment coverage of up to $10,000.

Simple Bike offers liability coverage up to $100,000.

Spoke

Spoke bicycle insurance sells coverage for various styles of bikes, together with mountain bikes, electrical bikes, triathlons, commuter bikes, and road bikes.

you'll be able to purchase coverage sorts like spare components and accessories, thieving protection, and cost coverage, that pays the complete worth of your bike if it’s purloined or broken thanks to a tangle lined by your policy.

you'll be able to conjointly purchase medical payment coverage in amounts starting from $1,000 to $10,000.

Spoke offers liability coverage in amounts starting from $25,000 to $100,000.

Sundays Insurance

Sunday's bicycle insurance is for road bikes, mountain bikes, and electronic bikes, up to $21,500 for every bike in your assortment.

you'll be able to purchase coverage sorts like accidental injury, sport and event coverage, and coverage for custom components.

You'll be able to get me on my feet with $1,000 of coverage for emergency medical expenses.

Sundays don't supply liability coverage.

Velosurance

Velosurance bicycle insurance can pay the complete worth of your bike if it's purloined or broken thanks to a tangle lined by the policy.

the corporate sell further coverage sorts like crash and accidental injury coverage, injury or loss in transit, and electrical bike coverage.

You'll be able to get medical coverage to cover the deductible of your personal insurance policy.

Velosurance offers liability coverage in amounts of $25,000, $50,000, or $100,000 per prevalence.

.png)

.png)

.png)

.png)

.png)

.png)

Comments

Post a Comment